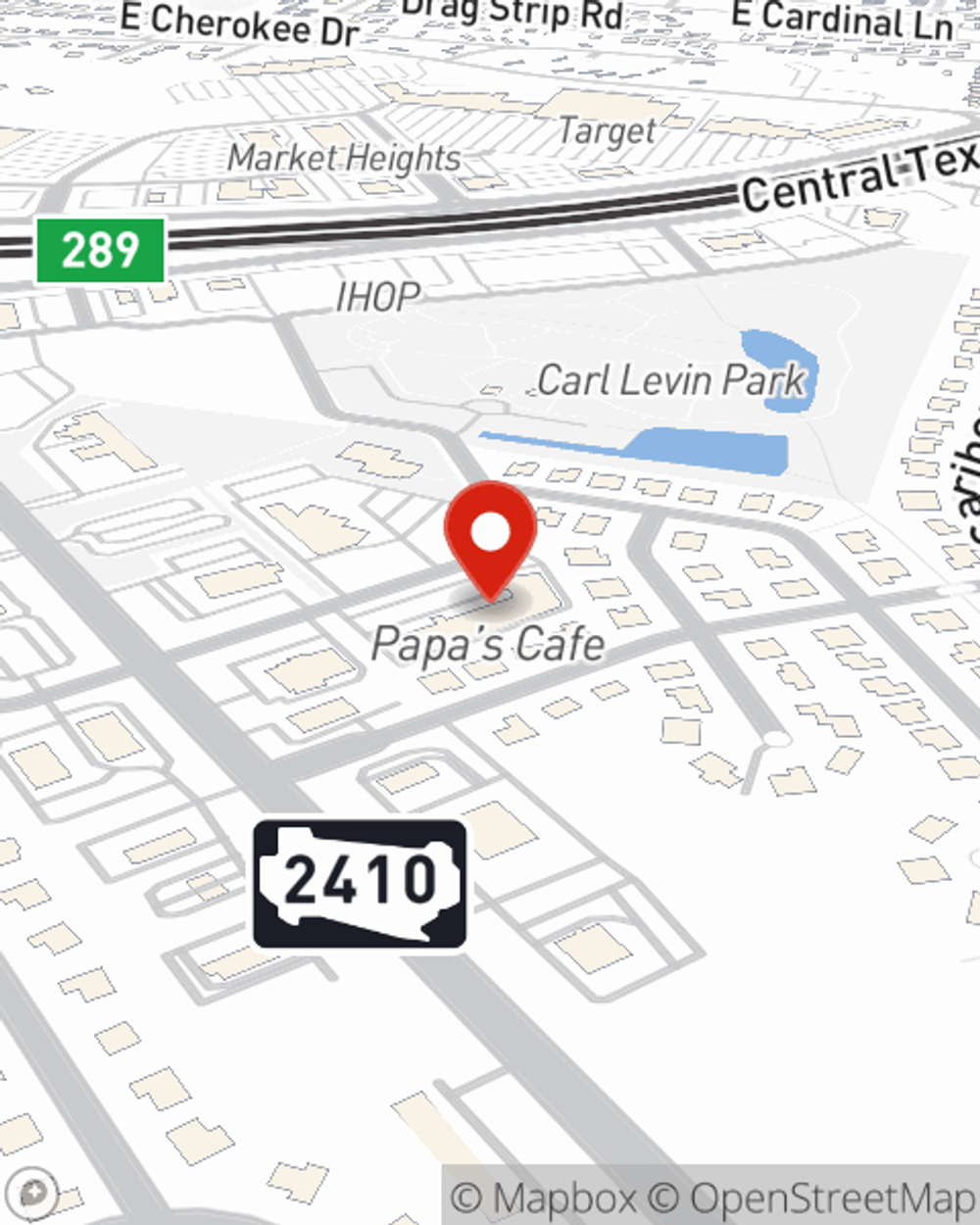

Business Insurance in and around Harker Heights

One of Harker Heights’s top choices for small business insurance.

Helping insure small businesses since 1935

- Belton

- Copperas Cove

- Ding Dong

- Florence

- Georgetown

- Harker Heights

- Holland

- Jarrell

- Kempner

- Killeen

- Lampasas

- Oakalla

- Salado

- Temple

- Bell County

- Coryell County

- Lampasas County

- Travis County

- Williamson County

- Central Texas

Coverage With State Farm Can Help Your Small Business.

As a small business owner, you understand that running a business can be risky. Unfortunately, sometimes problems like a staff member getting hurt can happen on your business's property.

One of Harker Heights’s top choices for small business insurance.

Helping insure small businesses since 1935

Customizable Coverage For Your Business

Protecting your business from these potential accidents is as easy as choosing State Farm. With this small business insurance, agent Leah McGee can not only help you design a policy that will fit your needs, but can also help you submit a claim should a problem like this arise.

Don’t let the unknown about your business stress you out! Get in touch with State Farm agent Leah McGee today, and explore how you can benefit from State Farm small business insurance.

Simple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.

Leah McGee

State Farm® Insurance AgentSimple Insights®

Tips for tenant screening

Tips for tenant screening

Screening tenants is your key to success. Find out how to check tenant credit reports and perform a background check.

Employer-owned life insurance

Employer-owned life insurance

Find out about employer-owned life insurance policies and how they might play a vital role in the financial life of a business.